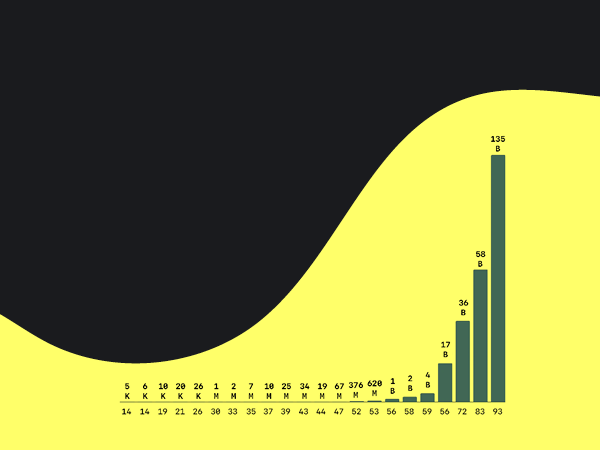

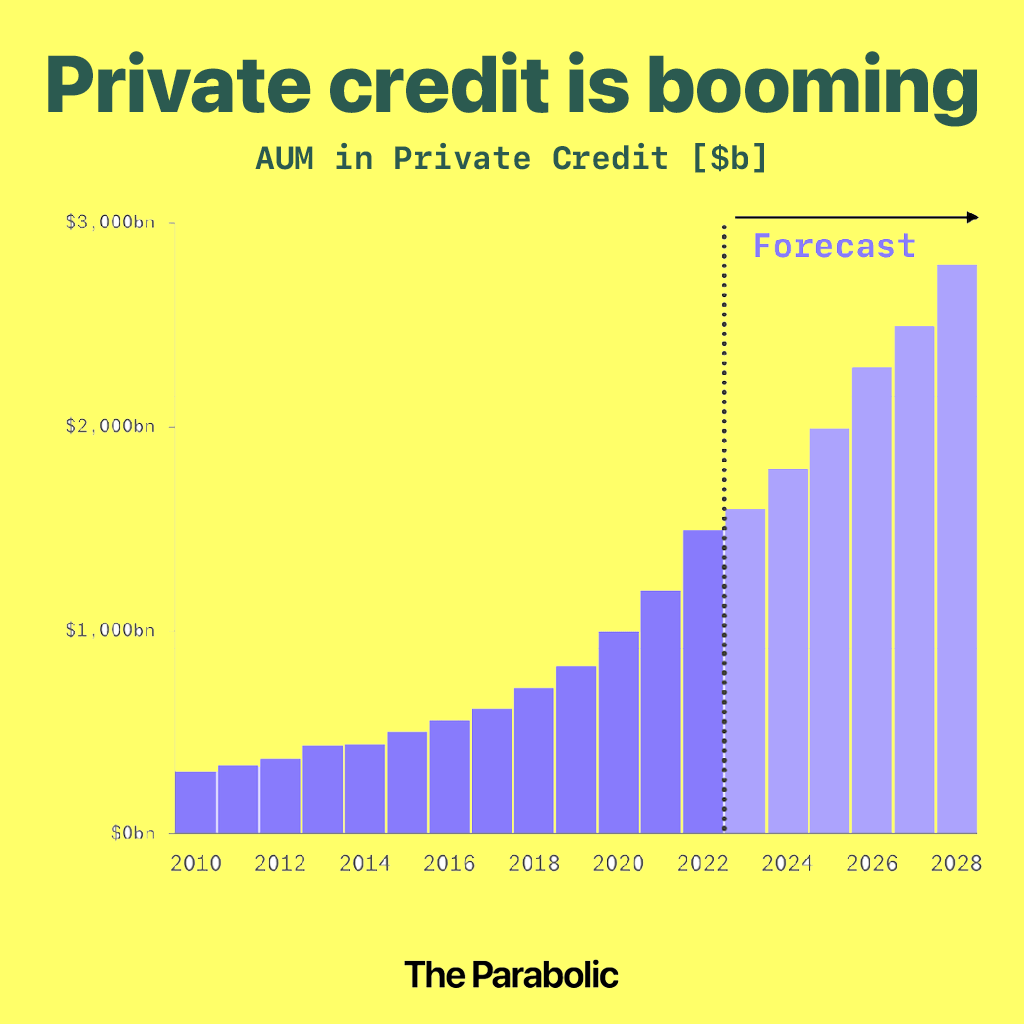

A key theme of this newsletter is the tsunami of Western debt. The US government, businesses and consumers are adding more and more — it's accelerating.

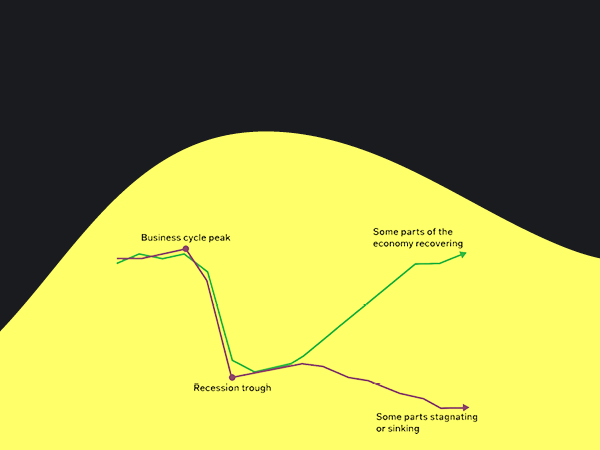

Debt-based financial systems — like ours — are inherently unstable. This demands endless innovation in new ways to add debt into the system to prevent collapse. And that's what today's chart is about:

Why it matters

Financial regulators are worried about the potential risks posed by the expansion of private credit:

- The Bank of England warned that private credit had become a serious vulnerability.

- The Federal Reserve's 2023 Financial Stability Report discussed the financial stability risks created by private credit.

The lack of transparency is another big concern.

Private credit funds disclose less about their performance, loans, and investors than banks. This limits the regulator’s ability to understand and monitor whatever the hell they are up to.

The IMF warns that:

If the asset class remains opaque and continues to grow exponentially under limited prudential oversight, the vulnerabilities of the private credit industry could become systemic.

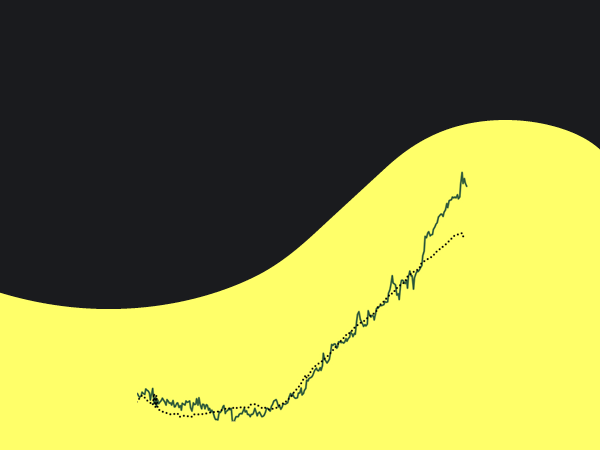

Yet, another good trend to track in the simplest way I know.