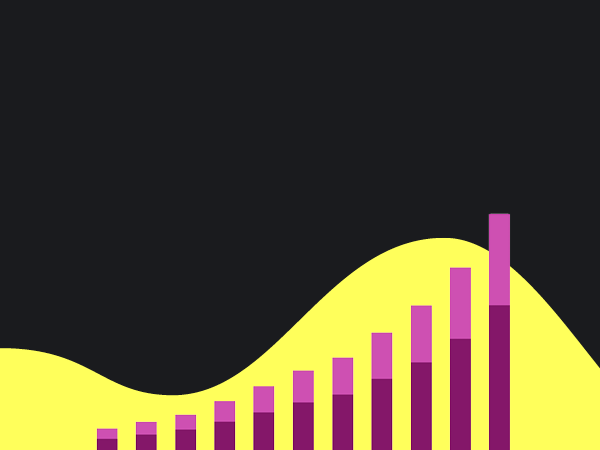

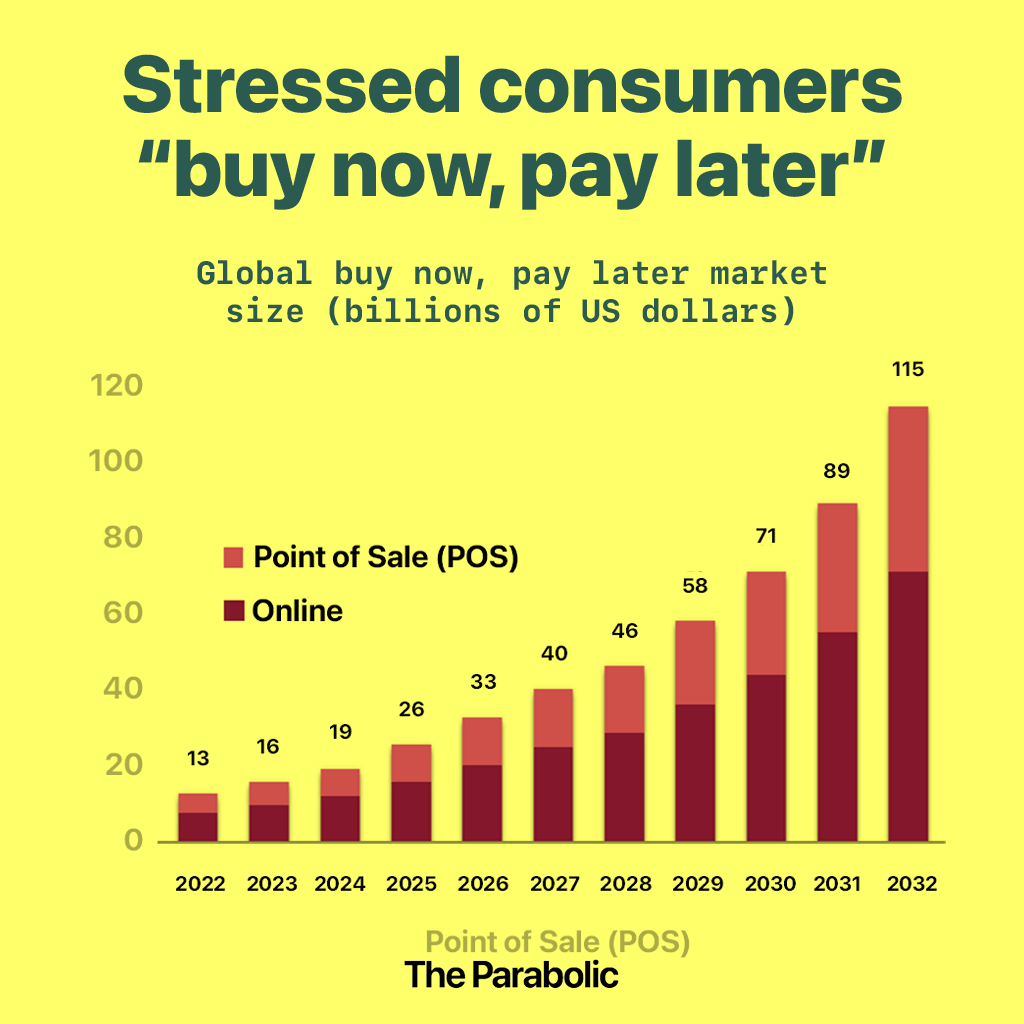

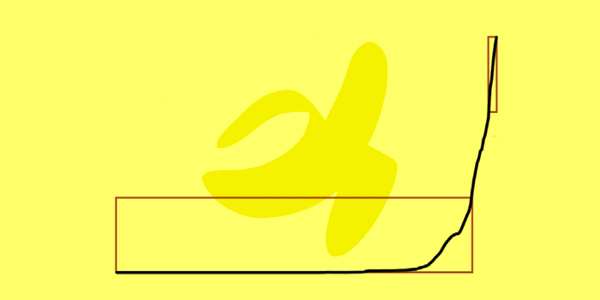

The Buy Now, Pay Later (BNPL) industry has gone parabolic, doubling in size in just two years. In 2023:

- Worldwide spending on BNPL purchases surged 18%, reaching $316 billion.

- In the United States, BNPL purchases soared to $95 billion, accounting for 5% of all e-commerce sales.

And in an era of economic uncertainty, consumers are turning to BNPL to get products they cannot quite afford.

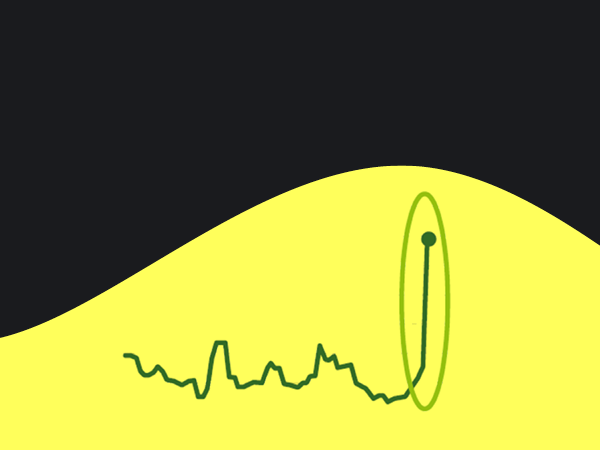

But there's a catch: new BNPL loans often go unreported on consumers' credit reports, leading to the accumulation of "phantom debt" — invisible to lenders and financial regulators.

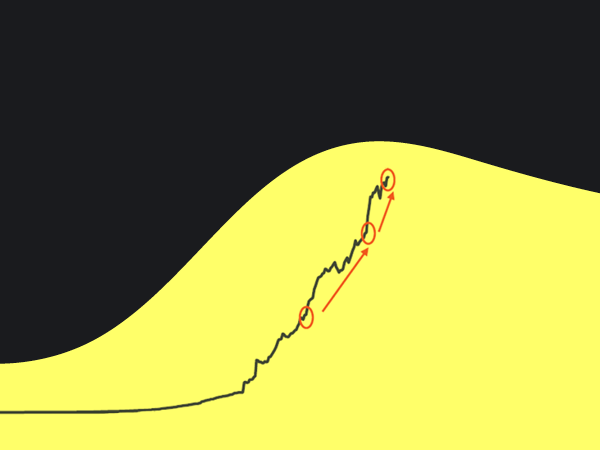

The BNPL industry is built on very shaky foundations. Many companies in the space are struggling to turn a profit, with shares in loss-making companies like Affirm falling by 80% from their 2021 peak. And Klarna, an industry giant, saw valuations collapse by 85% in just over a year.

Smaller BNPL firms have been shutting down left, right, and center, including Openpay, LatitudePay, ShopBack, PayLater, Zest, and Pace.

But the show must go on. Consumers must consume whether they can afford to or not. And more credit is the obvious solution to every debt problem.

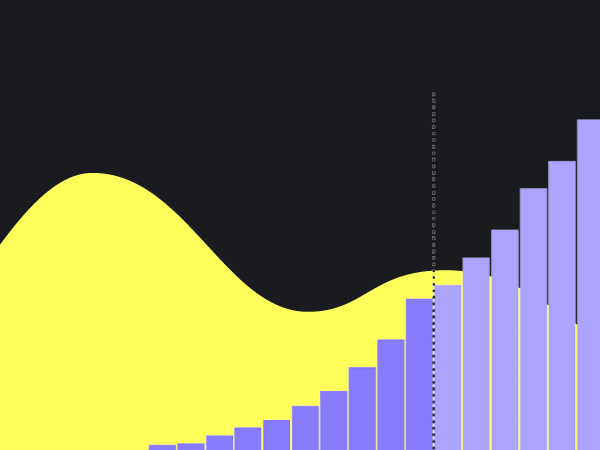

So bigger banks, payment groups, and tech giants like Apple, JPMorgan, Visa, and Mastercard want in on the BNPL action. And they're launching their own services to muscle in on the boom.

This makes it obvious — to me, anyway — that the BNPL phenomenon is just another symptom of the global debt megabubble that looms over the financial system.

Ok. Stay tuned for more parabolic charts and to get ahead of runaway, debt, finance and technology.

Take it easy.

Go deeper:

Via The FT