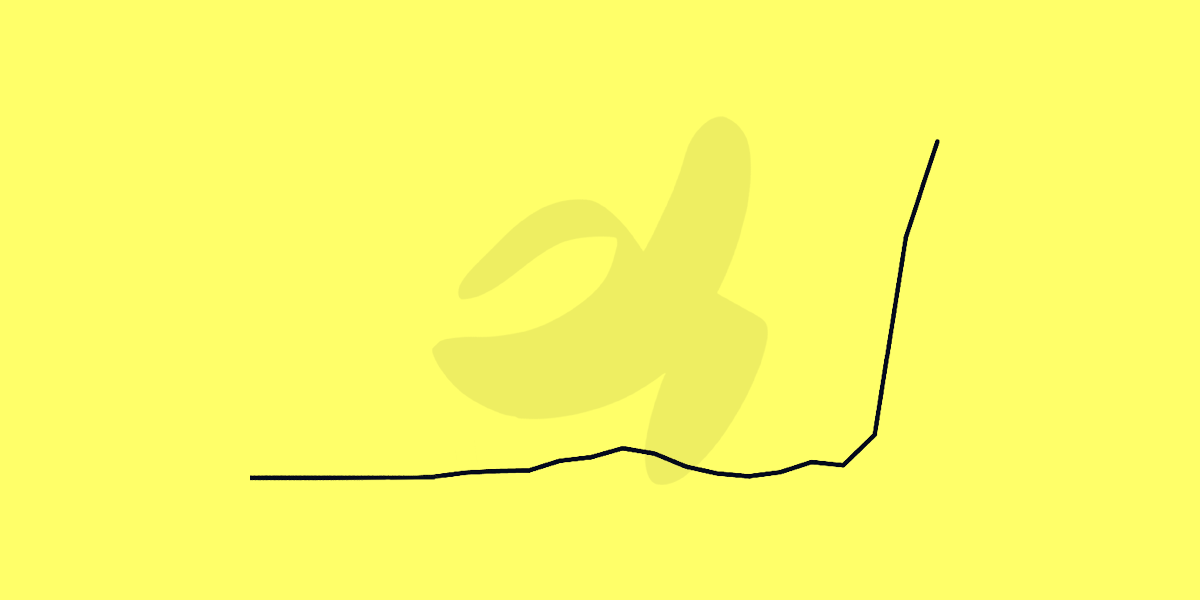

In response to the 2022 invasion of Ukraine, the EU launched 14 sanctions packages targeting Russia's oil and gas exports.

Russia, in turn, offered lower prices to major oil buyers. This created an opportunity for India to purchase discounted Russian crude oil, refine it, and sell it to EU countries for a healthy profit.

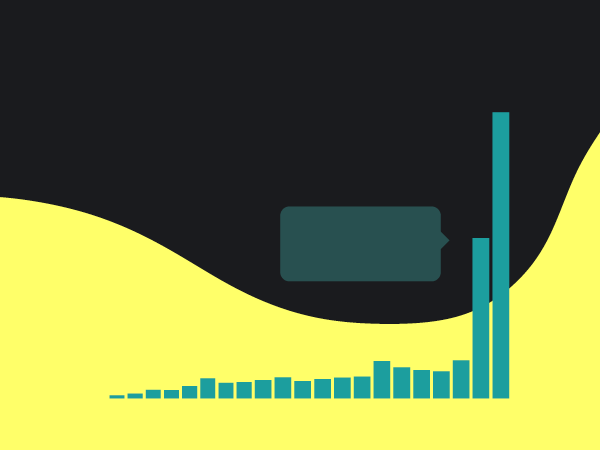

India used the opportunity to became the top importer of Russian crude oil, increasing 140% in 2023, to an average 1.75 million barrels per day.

Matt Smith, Kepler's lead analyst, explains:

This is undermining sanctions. It is impossible to extricate Russian crude from the global market. Russia is such a key player that they don't want to eradicate Russian supply.

Short version:

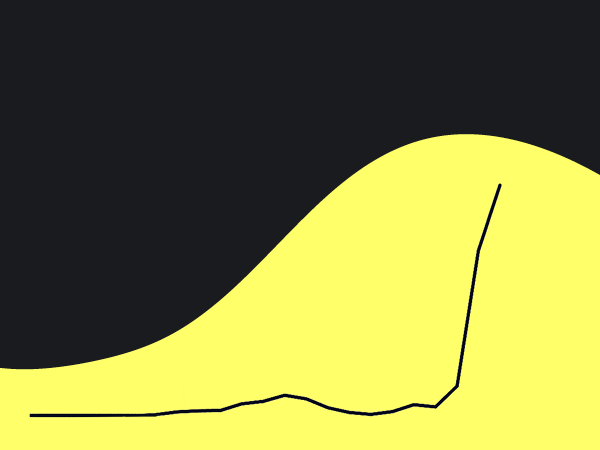

So far, the EU's sanctions have done more damage to Europe's economy than to Russia's. Their main outcome is to make oil and gas much more expensive, threatening Europe's energy security and industrial base.

Example: The European Commission warned that permanently higher energy prices cause inflation, which harms the EU's competitiveness in the long term.

The result: The refusal of the "global south" to side with the West has exposed the EU's sanctions as ineffective. Expect Europeans to continue paying a lot more for indirect purchases of the same Russian oil that EU leaders have banned.

Go deeper:

Attempts to end the EU's reliance on Russian oil has led to a megaboom for US liquified natural gas (LNG) producers:

EU sanctions were intended to harm Russia economy, but they harm the EU more:

Via Econovis and Times of India