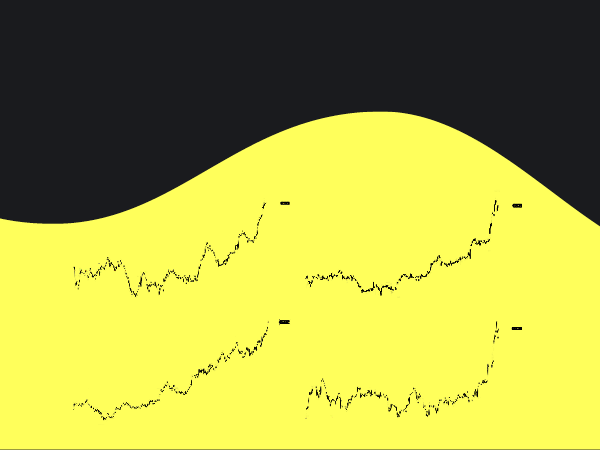

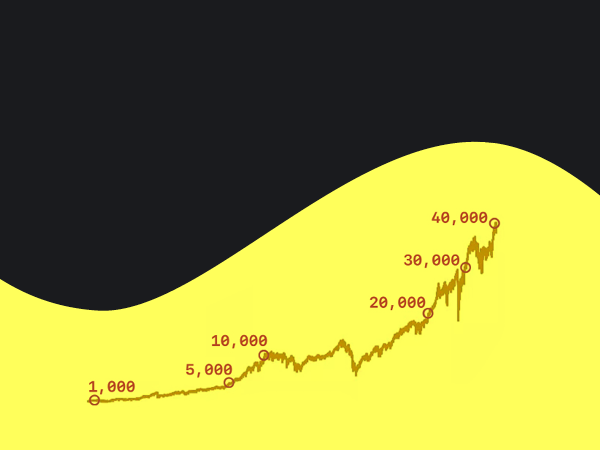

Weakening currencies can drive stock markets to new highs:

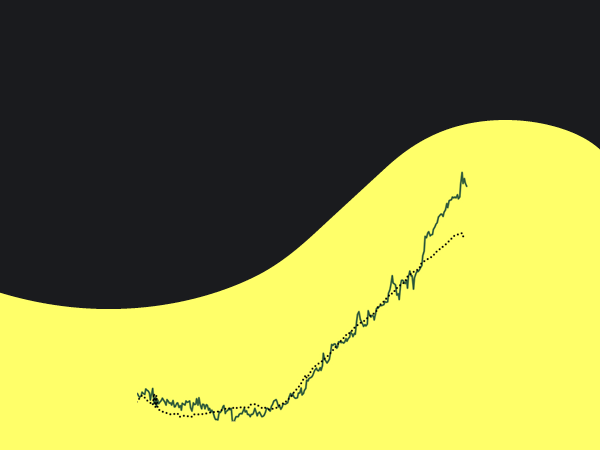

Zoom Out: Dow hits 40k

Big picture: Skyrocketing stock markets can signal failing currencies.

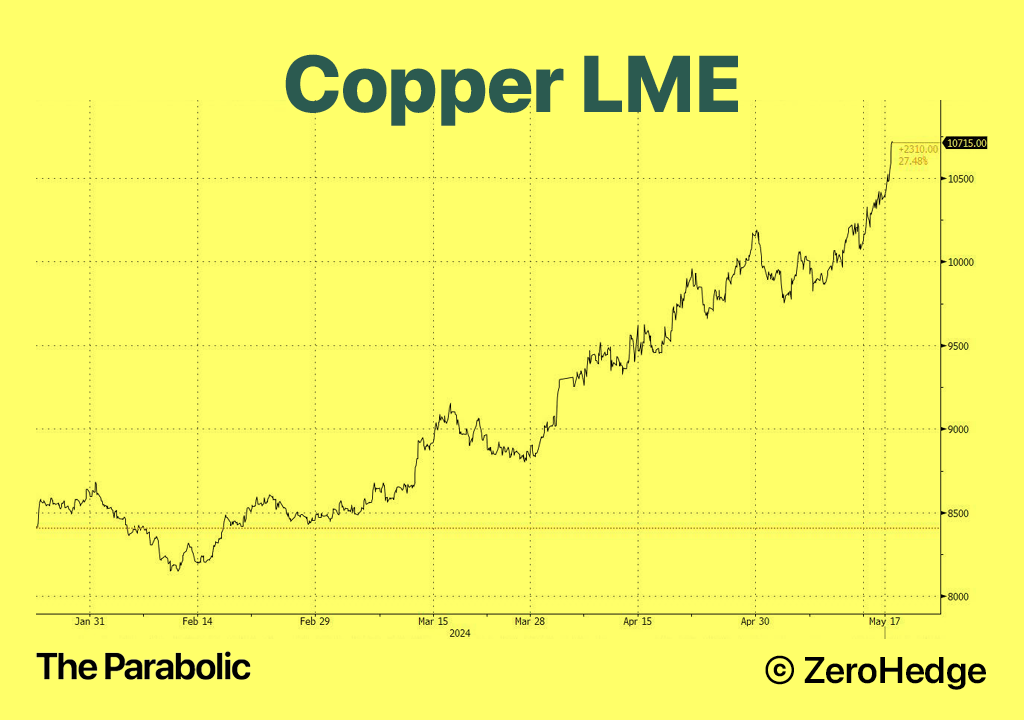

Today, we see that the same thing happening in commodities:

Copper surged to a new all-time high

This surge may be driven by China's attempts to take control of copper supply chains. Analyst Andreas Steno Larsen is waiting to see if this really is a deliberate power grab on supply chains.

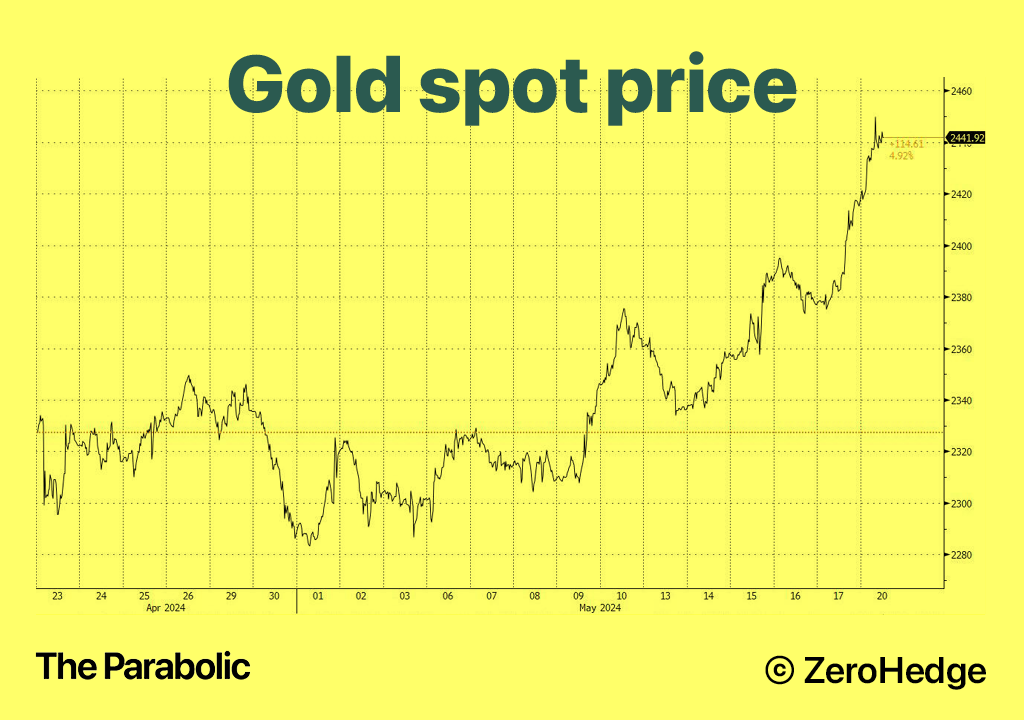

Gold is up +18% this year — and looks set for $2,500/oz

Silver is up 12% last week and went higher today.

Nickel, has not yet hit all-time highs, but is getting there.

Why it matters

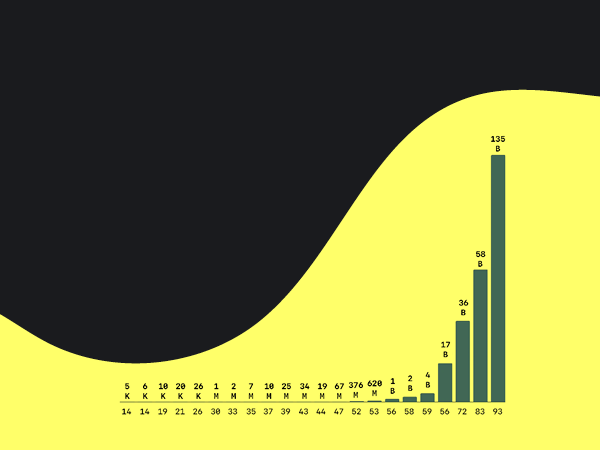

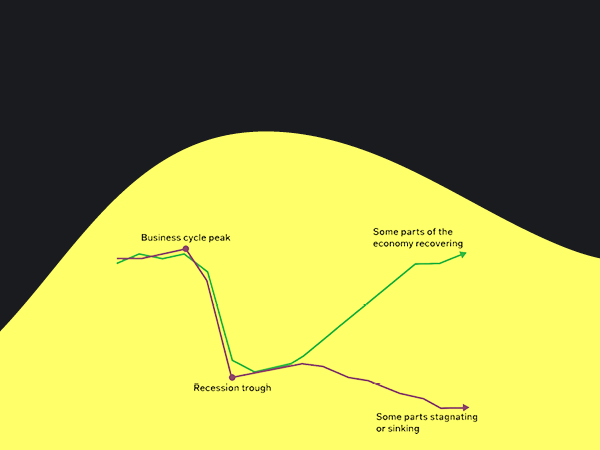

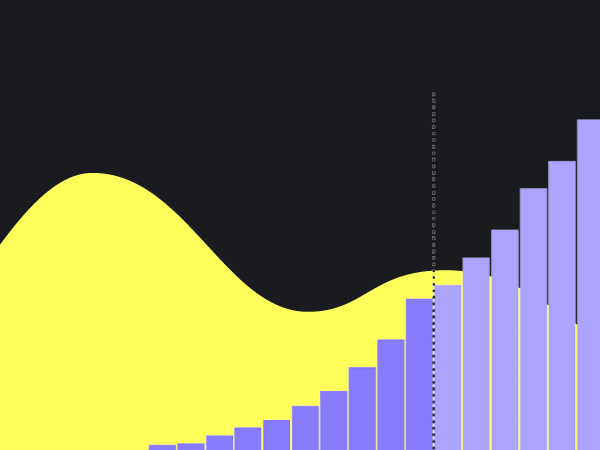

The recent surge in gold, silver, copper and nickel prices to new highs could indicate the onset of a commodity supercycle.

A supercycle is a prolonged period of rising commodity prices, driven by factors like inflation, geopolitical tensions, supply chain disruptions, and attempts to hit green energy goals.

Commodity supercycles are marked by growing demand for "real stuff" and higher asset prices. Supercycles can last for years, or decades, and often lead economic growth.

Commodity supercycles are marked by growing demand for "real stuff" and higher asset prices. Supercycles can last for years, or decades, and often lead economic growth.

As discussed yesterday, inflation is a key driver behind rallies across asset classes. Also, rising trade tensions and political instability in producer nations bring uncertainty, supporting rising prices.

Via ZeroHedge