Financial markets are flying higher than ever:

But clients and customers tell me something doesn't "feel right".

Some name this the "exponential age", others an "everything bubble". Whatever you call it, its clear that fear and greed are running wild.

A core problem is the accelerating erosion of the US dollar's purchasing power, making everything more expensive.

Today, three charts from Jesse Colombo define the problem (a century of currency devaluation) and the solution (a rising price of gold).

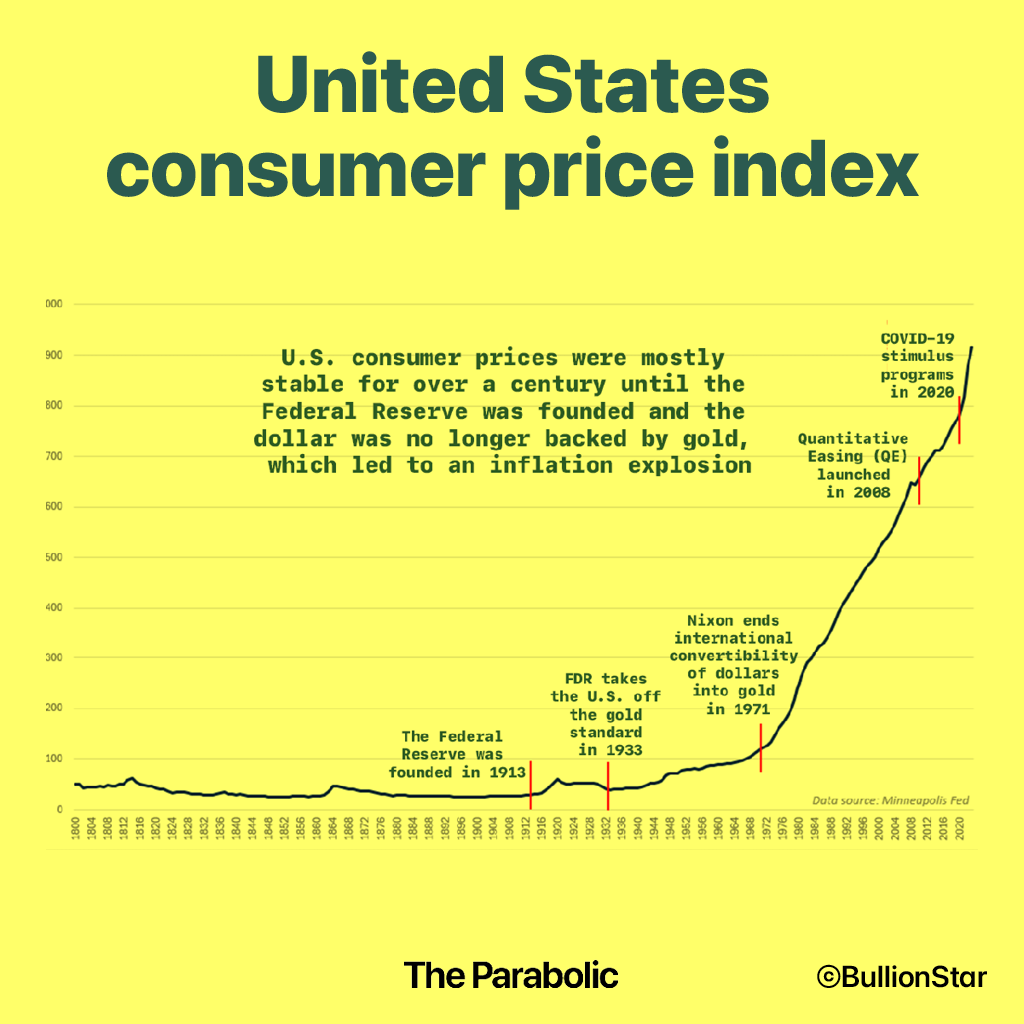

The problem: Currency devaluation

Most people are unaware that U.S. consumer prices were largely stable for nearly a century until the Federal Reserve was founded in 1913, which let the inflation genie out of the bottle in a tremendous way. Since the Fed was founded, US consumer prices have increased 30x!

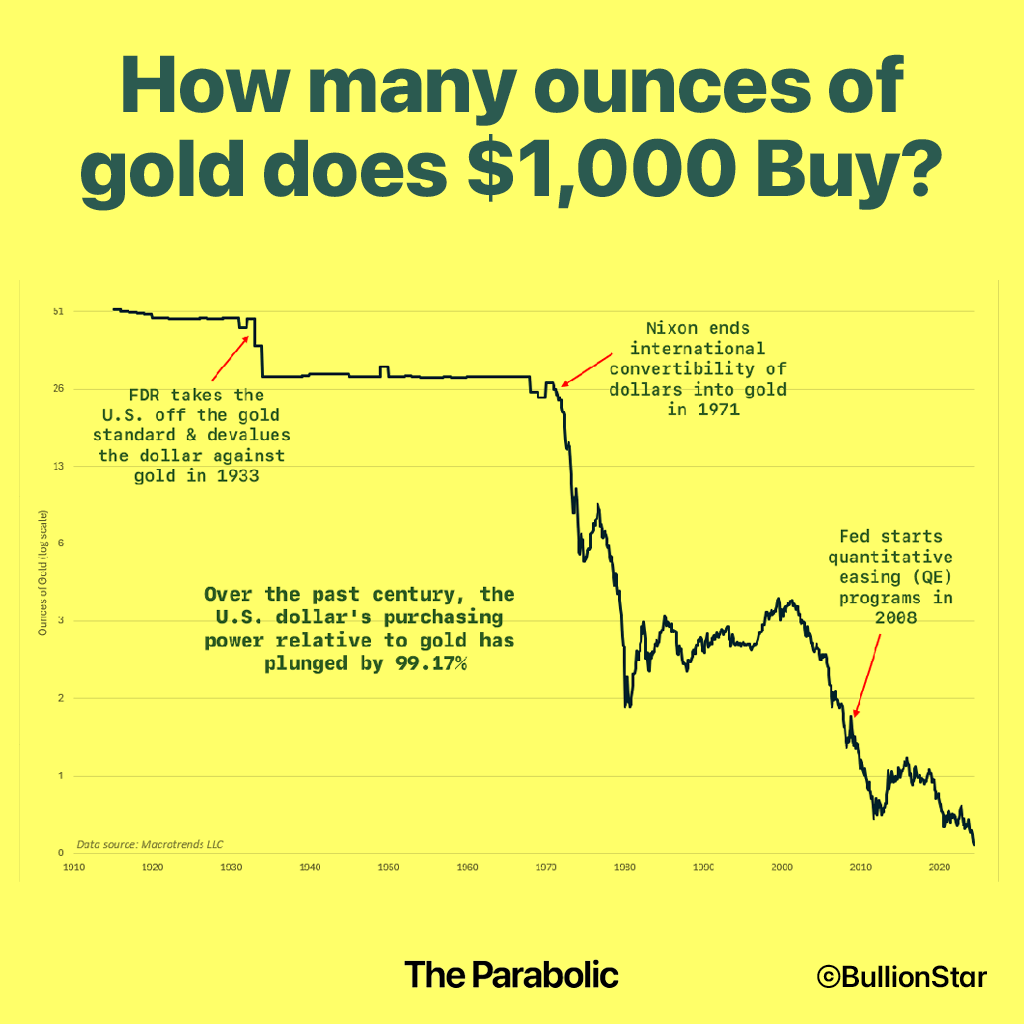

Another way of visualizing the dollar’s stunning loss of purchasing power is by comparing it to gold. Over the past century, the US dollar’s purchasing power has plunged by 99.17% relative to gold.

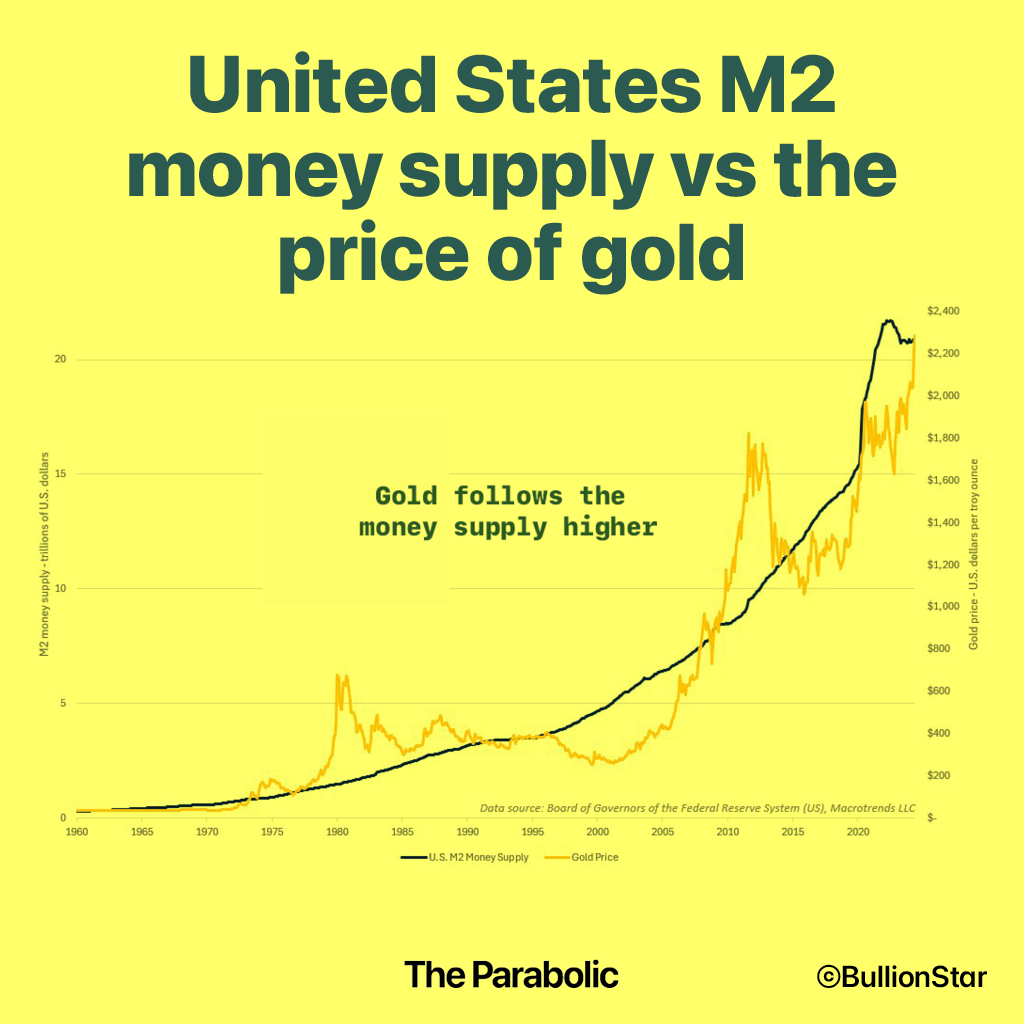

The solution: A rising gold price

The chart below shows how gold follows the US M2 money supply higher over the long run — that's how everyday people can protect their wealth against the ravages of inflation.

Today's parabolic charts show that the Federal Reserve is doing a great job of advertising gold, by devaluing their own, competing product.

Via Jesse Columbo / Bullionstar