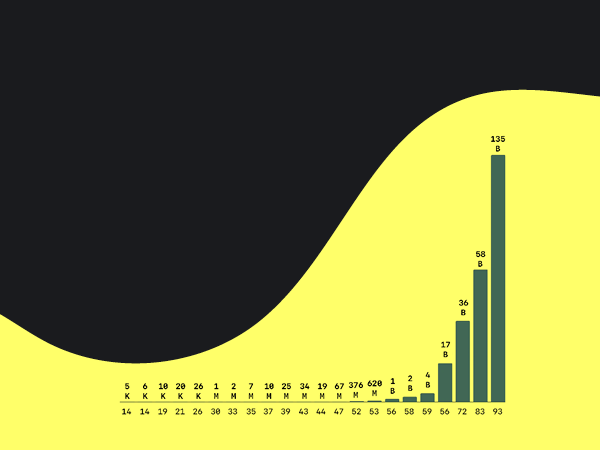

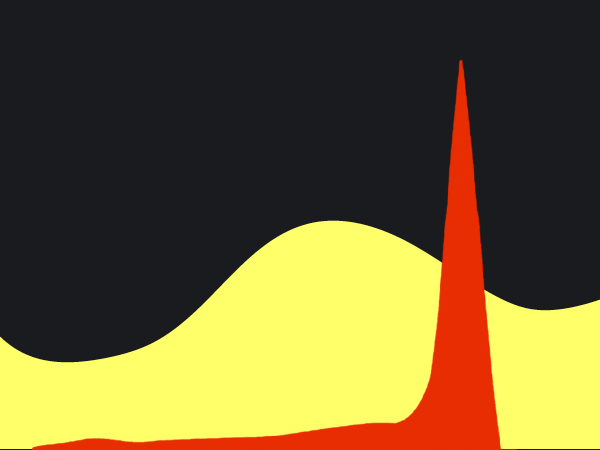

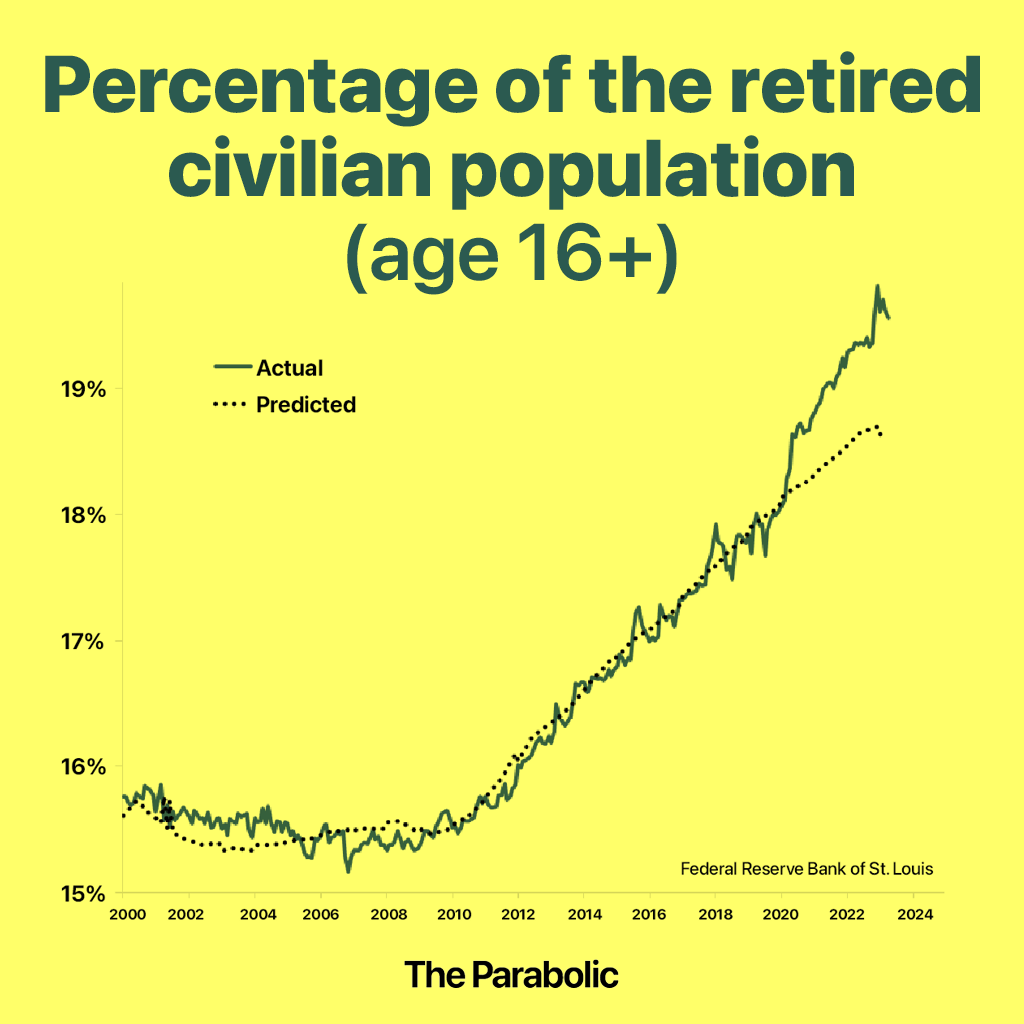

The COVID-19 pandemic led millions of Americans to bring forward their retirements.

The New York Fed finds that only 46% of people under 62 planned to continue working — a sharp decrease from before the pandemic. And they're retiring in "greater numbers than what would have been expected under normal conditions."

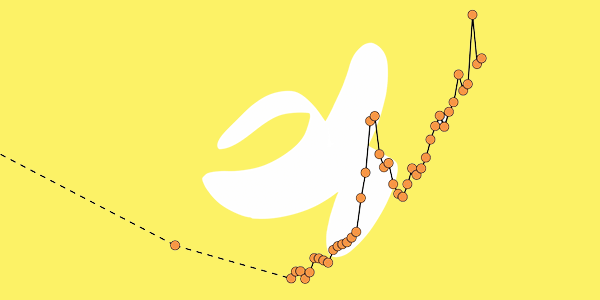

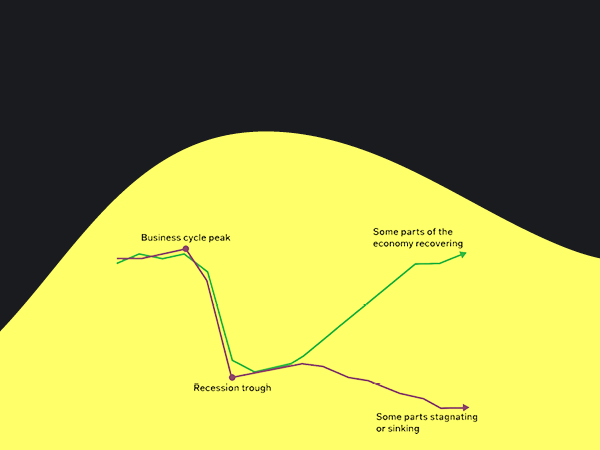

Today's chart shows the difference between what was expected and what happened.

For wealthy retirees, it's a matter of choice …

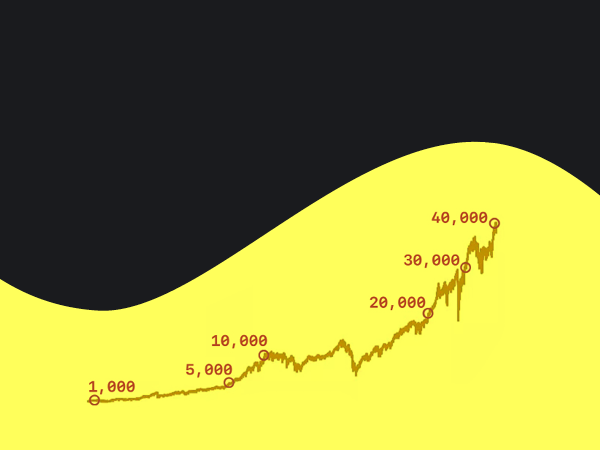

Covid-19 brought a wave of money printing — aka fiscal stimulus — by many governments. This inflated asset prices, increasing many investors' net worth, allowing them to exit the workforce earlier than planned.

For others, not so much

Advancing technology and automation are disrupting industries. This brings job losses and uncertainty for workers. Along with the rise of the gig economy and increasing job instability, many Americans simply opt for early retirement to escape the uncertainty.

The big picture

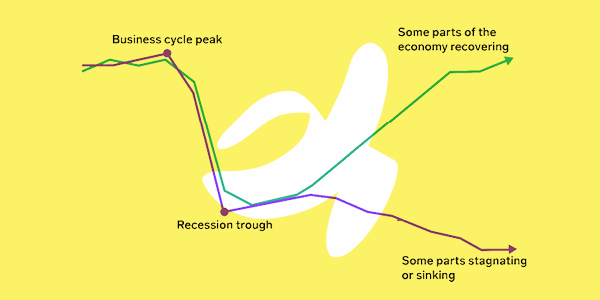

This trend highlights rising inequality in the "K-shaped economy", where some segments of the population experience rapid financial growth while others face stagnation or decline.

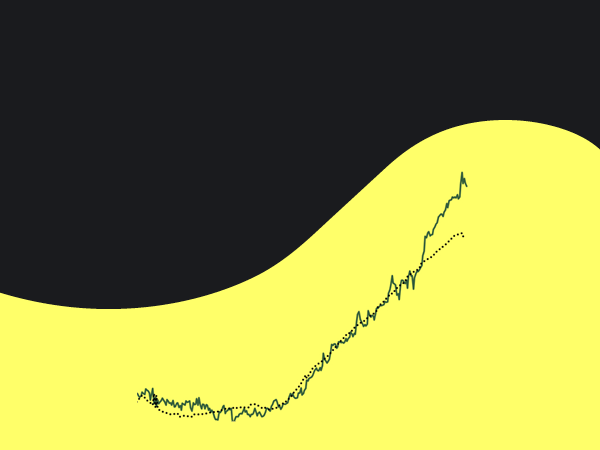

Like many exponential growth stories, this comes back to currency and debt problems.

Increased liquidity — aka 'money printing' — is driving stock markets and commodity prices to all-time highs.

For some Americans, these financial gains have provided the means to retire comfortably without relying on a steady income from work. For others, the future looks grim.

Go deeper …