Stablecoins are a type of cryptocurrency whose value is pegged to another asset — usually the US dollar — to maintain a stable price.

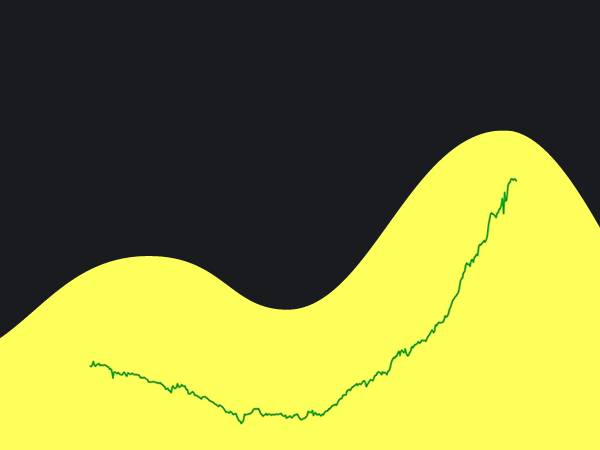

Today's chart shows the incredible rise of this new asset class — to a market cap of more than 150 billion dollars.

Why it matters

Tether is a leading stablecoin and has directed billions of dollars into Bitcoin, creating a "virtuous cycle" of crypto growth and Tether expansion.

Bennett Tomlin explains:

Tether is one of the most systemically important financial firms, making billions in profits every quarter.

Stablecoins are digital currencies that are — in theory — backed one-for-one with "real" money. The theory is that stablecoins are only minted when real fiat is deposited with the issuer.

Some have doubts.

The pessimistic take

According to Doomberg [🔒]:

A big, gaping loophole opens by their primary use as a medium of exchange in cryptocurrency trading: stablecoins can be used to buy other digital assets – Bitcoin, for example – that can in turn be posted at various off-ramp payment rails in exchange for actual currency. Given the unregulated nature of the crypto universe, there is seemingly nothing to stop stablecoin issuers from printing phony versions of digital dollars (backed by nothing) and employing mules to make change at those points of exit.

The optimistic take

Stephen McBride, chief analyst & portfolio manager at RiskHedge sees a bigger picture:

Stablecoin volumes passed Mastercard last year. And with monthly transactions hitting $2 trillion, they’re on track to knock Visa off its payments perch this year. 𝐌𝐨𝐫𝐞 𝐦𝐨𝐧𝐞𝐲 𝐧𝐨𝐰 𝐦𝐨𝐯𝐞𝐬 𝐚𝐥𝐨𝐧𝐠 𝐜𝐫𝐲𝐩𝐭𝐨 𝐫𝐚𝐢𝐥𝐬 𝐭𝐡𝐚𝐧 𝐨𝐧 𝐭𝐡𝐞 𝐰𝐨𝐫𝐥𝐝’𝐬 𝐦𝐨𝐬𝐭 𝐰𝐢𝐝𝐞𝐥𝐲 𝐮𝐬𝐞𝐝 𝐩𝐚𝐲𝐦𝐞𝐧𝐭 𝐧𝐞𝐭𝐰𝐨𝐫𝐤𝐬. …

And:

Mark my words: You’ll soon be using stablecoins too. Just last week, payments giant Stripe integrated stablecoins into its platform.You can now buy billions of goods on the internet using crypto.

What's next?

The integration of stablecoins into mainstream payment systems like Stripe shows a rapidly evolving financial landscape. And, as with any emerging asset class, there are both dangers and opportunities.

Doomberg highlights the potential for fraud, while Stephen McBride sees the sheer volume of transactions as a revolution.

I don't know how long the rise of stablecoins will last. That's why I cover the big trends as simply as possible. So, stay tuned as I track rapid expansions happening across finance, tech, and more.