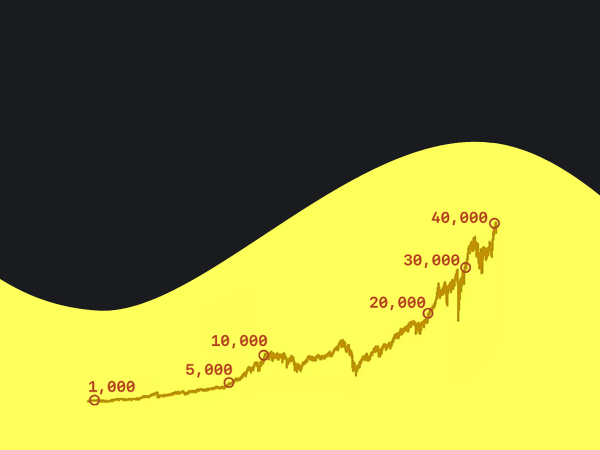

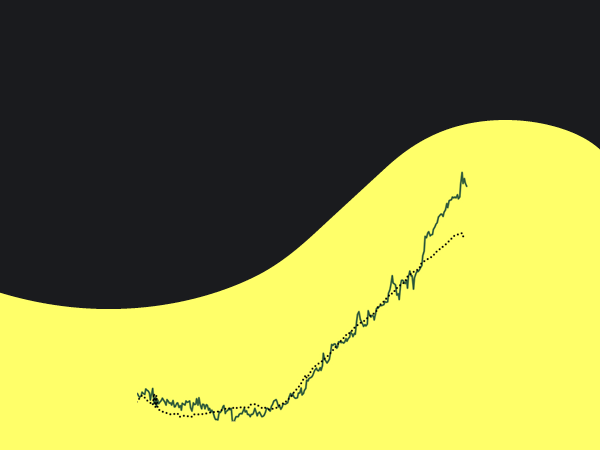

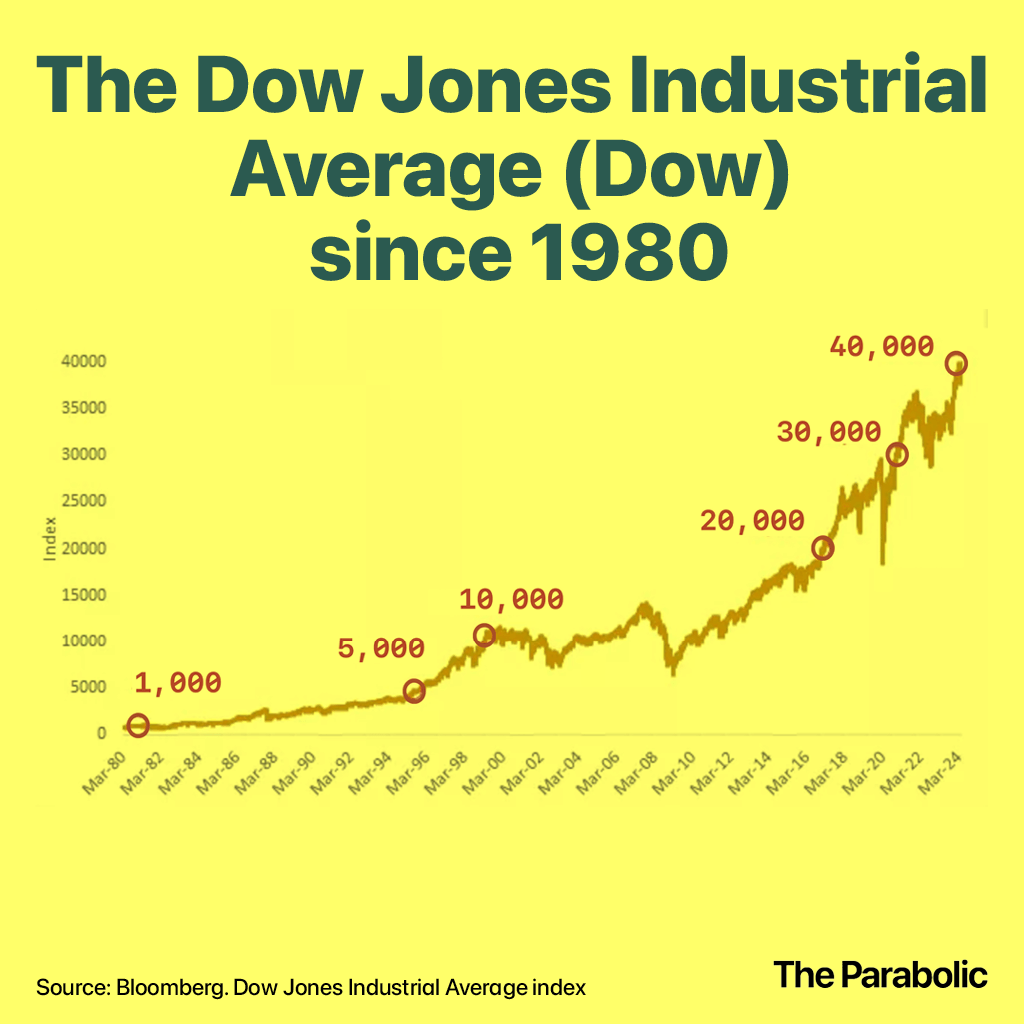

Last Thursday, the Dow Jones Industrial Average blew through 40,000 for the first time ever.

Team Biden credited the president with:

breaking economic records across the board – from record small business growth to historically low unemployment and now a new high for the Dow, strengthening Americans’ retirement plans.

Sounds awesome, right?

Just like in 2020, when the Dow hit 30,000 and President Donald hailed his "sacred number".So you might think that a high stock market is a good thing — reflecting economic strength.Not necessarily.

Although stock market highs can reflect genuine economic growth and prosperity, there is something fishy about the wealthiest 10% owning 89% of all US stocks. An even bigger problem might be what perma-highs say about the health of America's economy. History shows that stock markets hitting new highs can also signal a collapsing currency.

There are many examples.

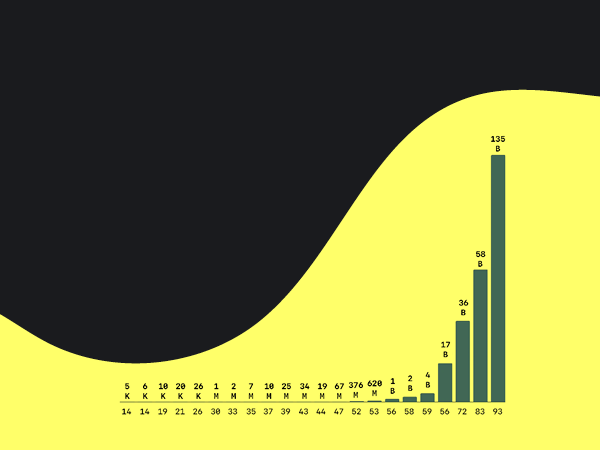

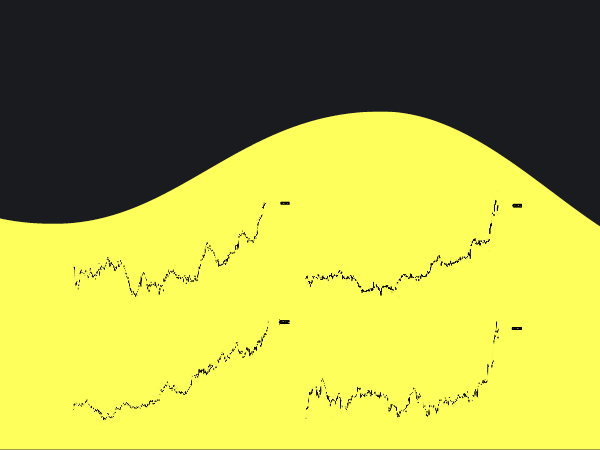

Argentina

100 years ago Argentina was one of the richest countries in the world. Since then, it has suffered multiple hyperinflations and replaced its currency five times.

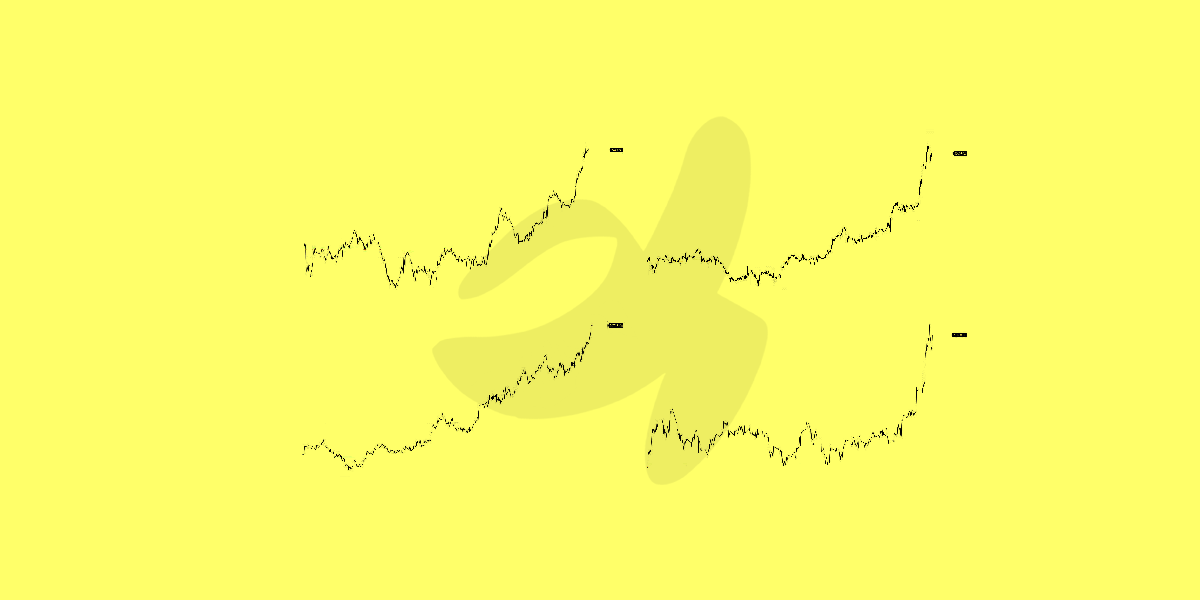

This drove their stock market to all-time highs 👇

Iran

In 2020 Iran's government slashed four zeros from their national currency to combat hyperinflation. Their stock market went to all-time highs 👇

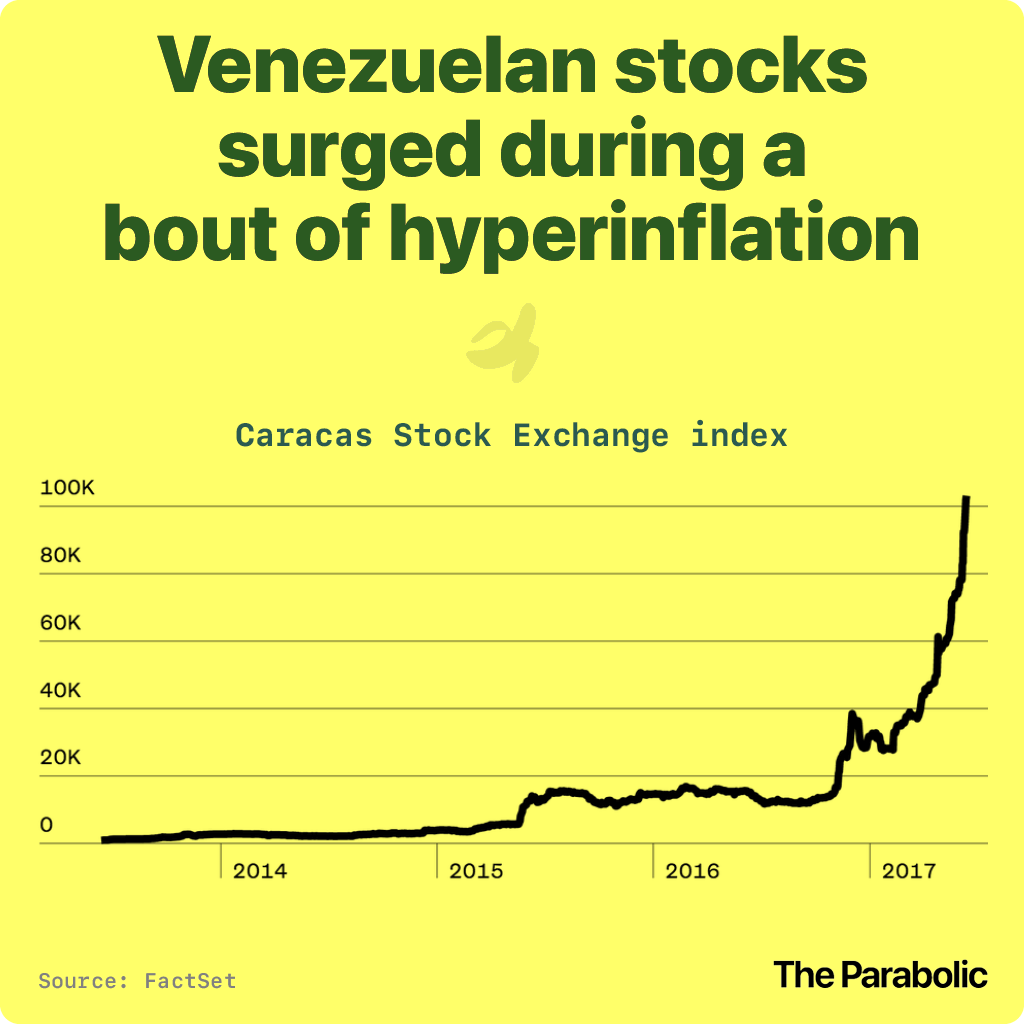

Venezuela

Extreme currency instability began during Venezuela's 2016 political crisis. Some blame their socialist government. Others blame American interference. Whatever the cause — as citizens were forced to eat rats and dogs — their stock market hit all-time highs 👇

Zimbabwe

Zimbabwe had the world's best-performing stock market as their currency hyper-inflated. Again, their stock market went to all-time highs 👇

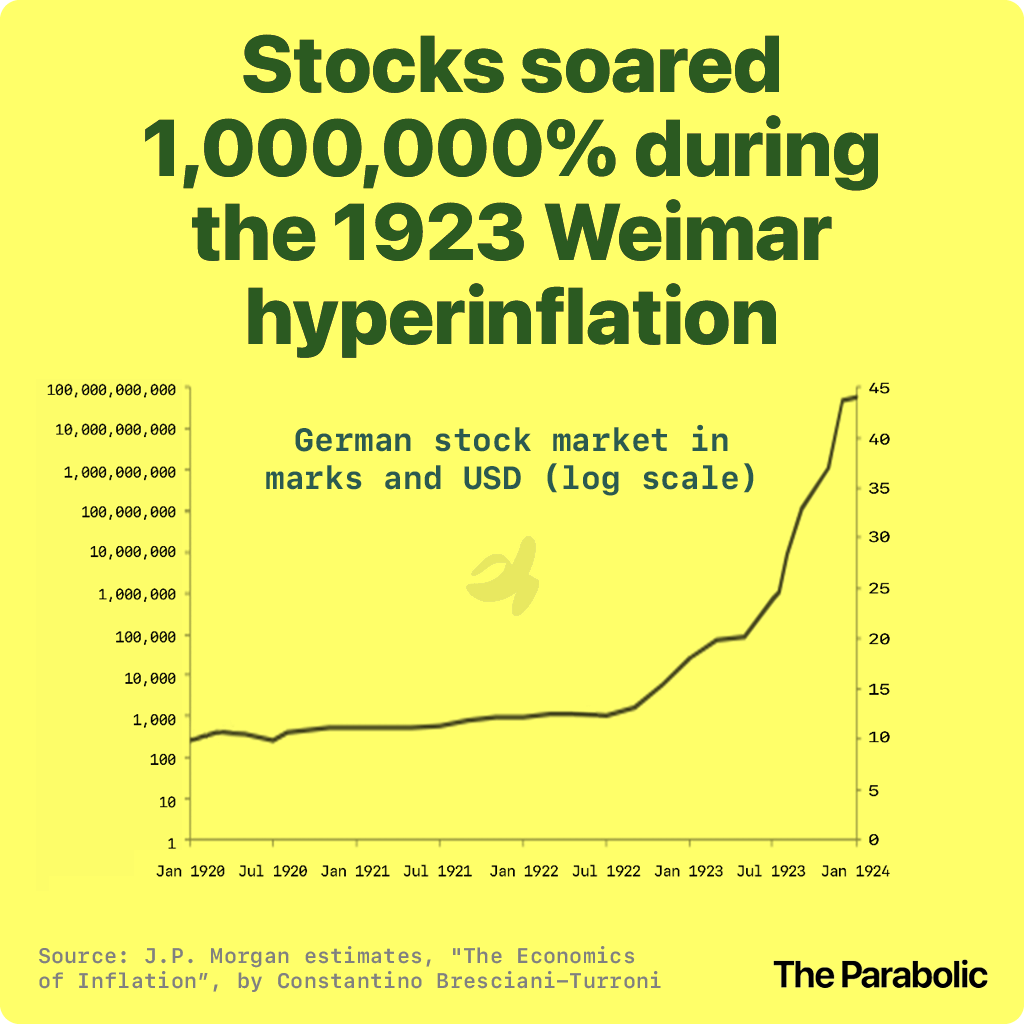

Weimar Germany

The Weimar Republic's stock market soared during their hyperinflation in the 1920s. Have a guess what their stock market did 👇

Why it matters

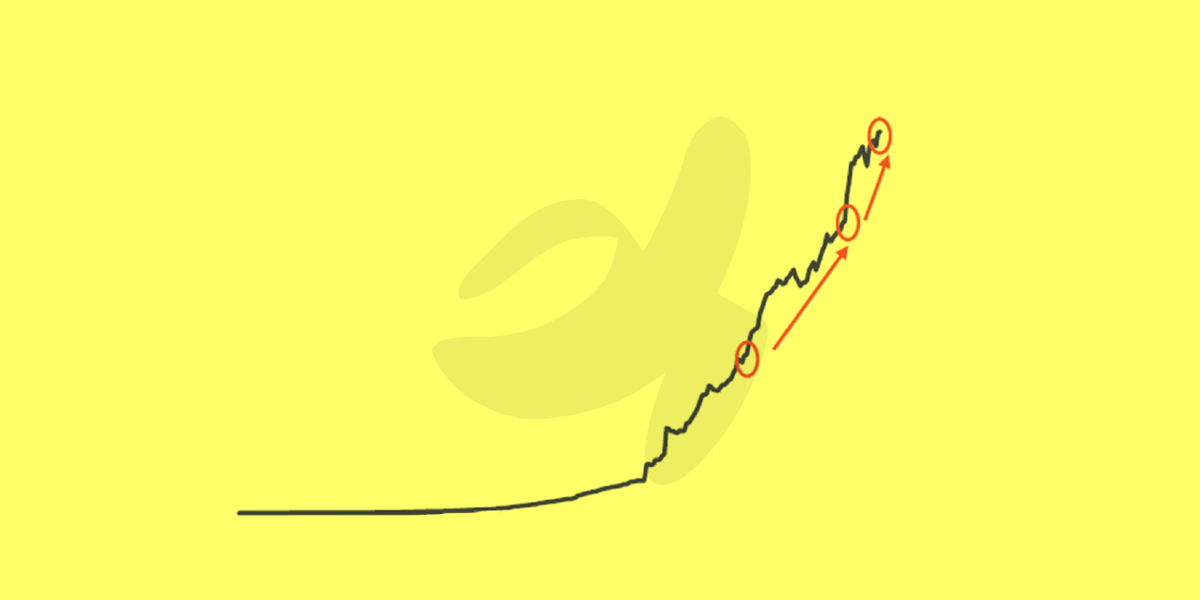

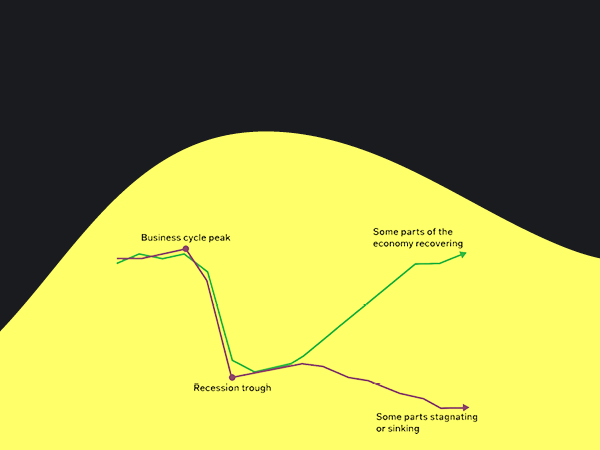

Inflation – or fear of inflation – causes people to swap currency for harder assets like real estate, precious metals, and stocks.

When investors fear that a currency will lose its value, they flock to assets that hold their worth. Stocks, particularly those of major corporations, are seen as safer havens. As a result, increased demand for stocks can drive prices to record highs — especially as the currency weakens further.Hyperinflation is unrestrained price increases — typically at rates of over 50% every month. This results in mass panic as people try to dump currency for whatever can be bought.

Is the US going the same way?

Very high inflation is not usually a 'first world' phenomenon. But the fact is, the US is taking on some characteristics of its South American neighbours.And three key indicators indicate that the collapse has already happened for millions of Americans:

- Real incomes are shrinking,

- life expectancy is falling, and

- 80% of people live paycheck to paycheck.

2024 is an election year in the US. Whether Biden or Trump wins the trajectory of monetary policy is unlikely to change much.

Expect policies that prioritize short-term economic gains over long-term stability, fuelling further money printing and debt monetization.This can artificially inflate stock market prices and create the illusion of prosperity, masking underlying economic vulnerabilities.

However, this approach brings us closer to a tipping point where excessive debt and inflation become impossible to ignore.

Go deeper: